In the 2018-2019 fiscal year, the Municipality of Pictou County collected $14 million in taxes from residents and businesses.

But do you know how that money is spent by the Municipality?

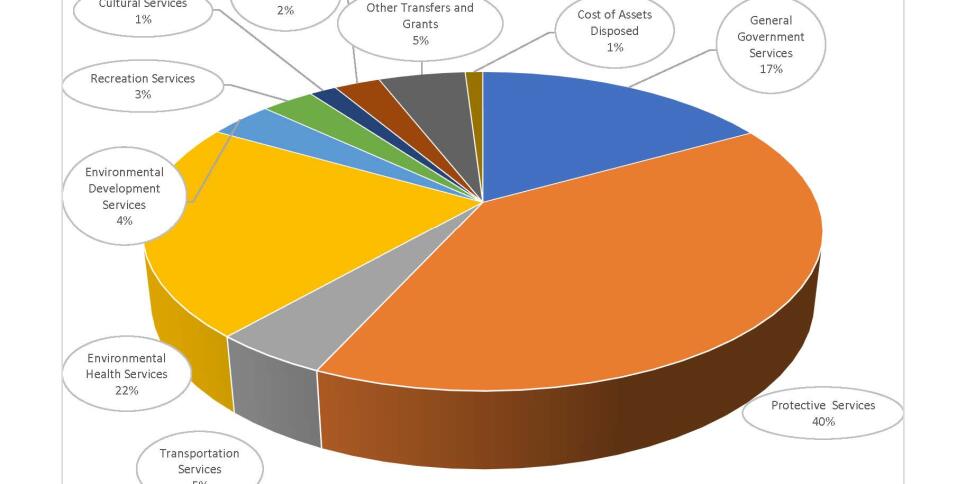

Here is a general breakdown that will help you see where your tax dollars are spent.

Protective Services – 40 percent or $6.3 million which includes policing, prosecution services, bylaw enforcement, emergency measures, building inspections, and fire.

Environmental Health Services – 22 percent or $2.3 million for such services provided by public works including sewer and water in addition to contracted garbage and recycling collection.

General Government Services – 17 percent or $2.5 million which includes administration fees, building maintenance, tax exemptions, and sales.

Other Transfers and Grants – 5 percent or $783,598 which used for municipal service grants, refugee assistance, and deed transfer tax.

Transportation Services – 5 percent or $741,686 allotted for streetlights, road maintenance (non-provincial roads) and sidewalks.

Environmental Development Services – 4 percent or $581,623 which is used for GIS and mapping, wind turbines, marketing, community grants, and regional development expenses.

Recreation Services – 3 percent or $476,257 for grants, council programs, recreation strategy and contributions to the Pictou County Wellness Centre Authority.

Remaining expenses – Water Utility 2 percent, cultural services 1 percent and cost of assets disposed of 1 percent

In addition, another $5 million is collected by the Municipality that goes directly to the provincial government to pay for such services as education, corrections, and the regional housing authority.

In Other News

MOPC developing new policy for agricultural lands

Join the Conversation! The Municipality is developing a new land use policy for agricultural lands in MOPC in order to meet Provincial requirements.

Read More

Nominations open for Volunteer of the Year

April 19th to 25th is National Volunteer Week.

Read More

Applications open for Municipality of Pictou County Citizen Appointments 2026-2028

The Municipality of the County of Pictou currently has vacancies for the following volunteer positions:

Accessibility Advisory Committee (8 positions)

Two-Year Term, April 1, 2026 – March 31, 2028

The Accessibility Advisory Committee…

Read More

View all news

Skip to Content

Skip to Content